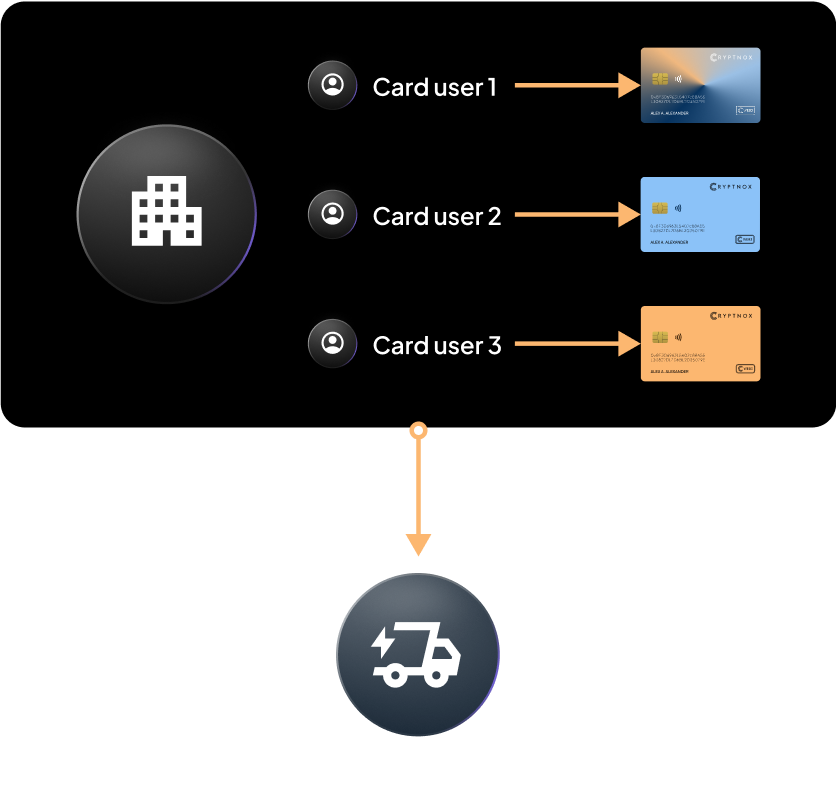

Cryptnox provides White Label Crypto cards for banks, fintechs, and financial institutions. White Label hardware wallets cards enable secure, user-friendly cryptocurrency management with full regulatory control.

This solution qualifies as “self-custody” as per EU, UAE & Swiss regulations.

Related granted patents: US 11791996 B2 – US 12101400 B2 – US 12132824B2

EAL6+ certified secure element meets regulatory definitions for “self-hosted” wallets

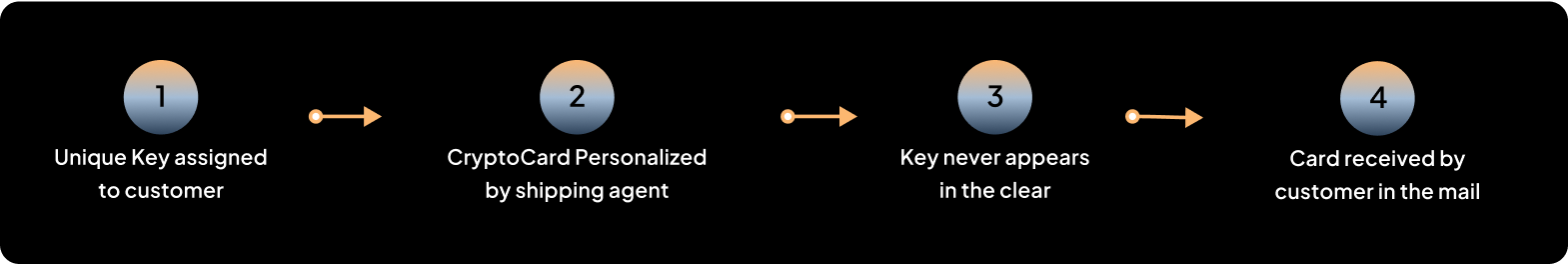

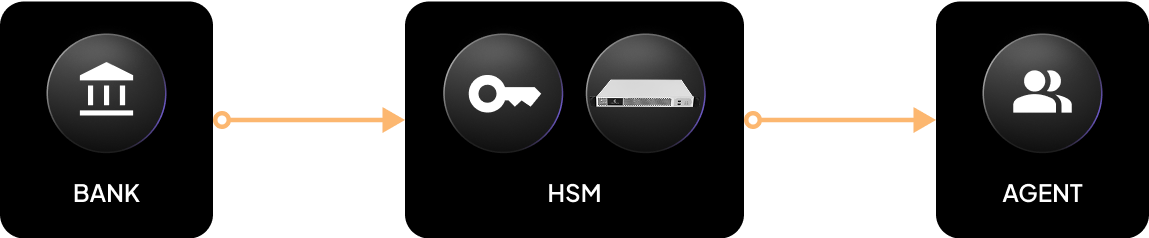

Cards are pre-initialized and ready to use

Lost card? Instantly issue a new one with the same private key

Protected by patents US 11,791,996 B2, 12,101,400 B2, and 12,132,824 B2

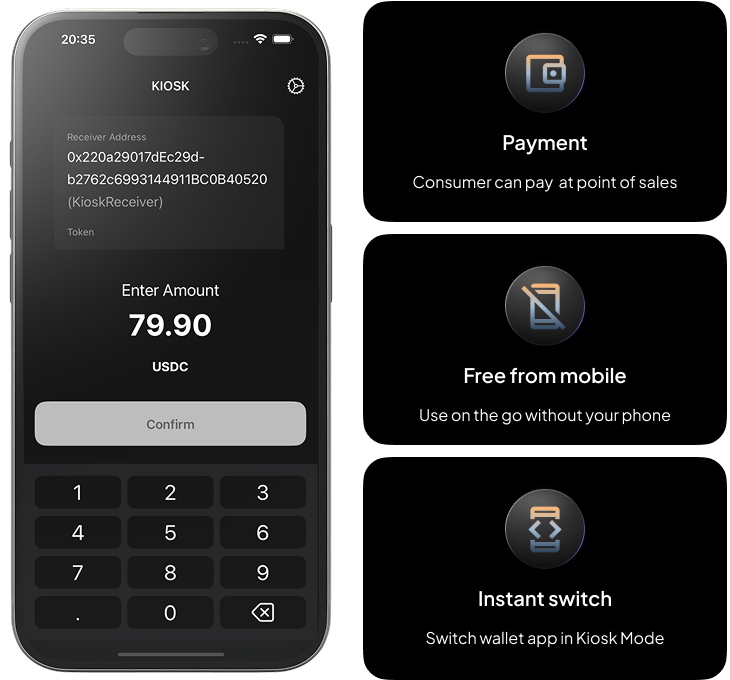

Crypto + EMV (Visa/Mastercard support)

Crypto + EMV + FIDO2 login (Online identification)

PIN & Face ID login

API-ready for EMV processors.

Web3 & DeFi-ready out of the box.

FIDO2/Security key login supported by major OS & browsers.

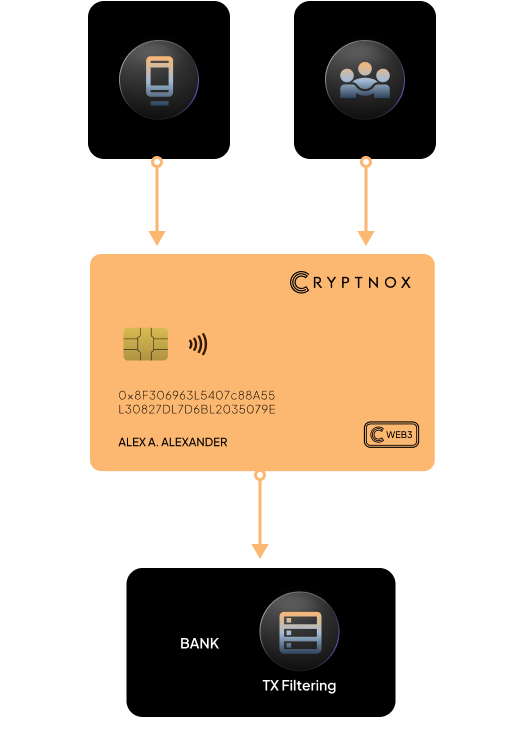

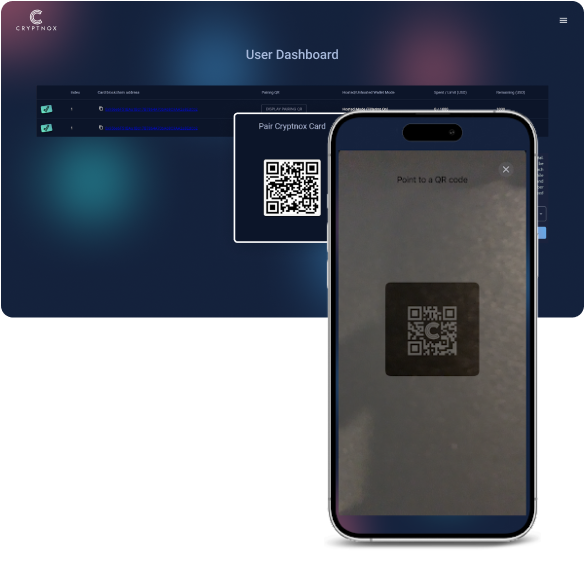

1.Scan a QR code online in the client user account.

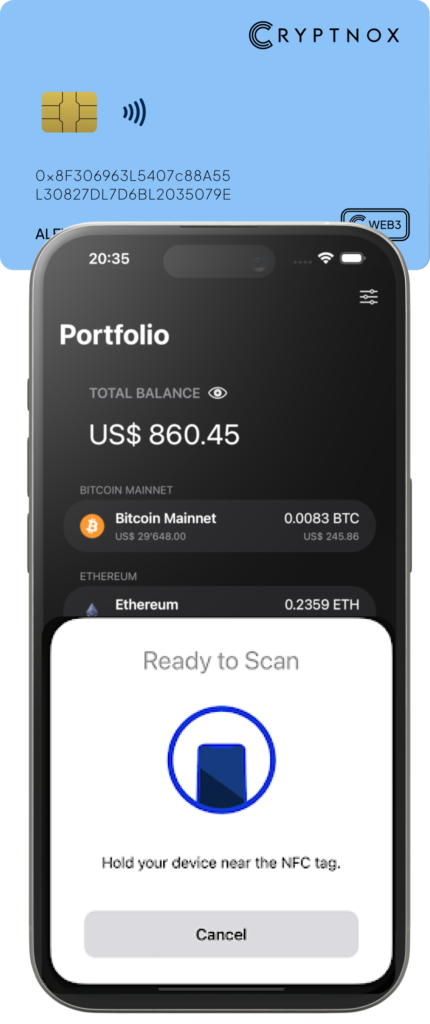

2. Tap the card at the back.

4. Server returns 2FA to phone

5. Card signs

6. Phone broadcasts transaction