Managing crypto doesn’t have to be complicated or risky. Ever wondered who actually has control of your crypto, you or a third party? That’s where self-custody wallets make all the difference.

Choosing a Hardware Wallet is one of the smartest moves for anyone serious about crypto security. These devices keep your private keys offline, making them nearly impossible to hack. If you’re new to this concept, start by learning What a Hardware Wallet is and how it protects your assets. Once you’re ready to take control, check out this step-by-step guide on How to use a Hardware Wallet to secure your digital wealth with confidence.

What is a Self-Custody Wallet?

A self-custody wallet is a tool that gives you complete control over your crypto. Instead of letting an exchange or another company hold your private keys, with self-custody, you keep those keys yourself. This means only you can access, send, or receive your digital funds, no one else can move your money unless you approve it. It’s a bit like being your own bank account manager, but with digital coins.

With self-custody wallets:

- You hold the private keys (the cryptographic code to unlock your assets)

- You alone decide when and how to use your funds

- There’s no middleman involved, so you’re not sharing control with anyone

There are different types of self-custody wallets:

- Hardware Wallets (physical devices like cards or USBs)

- Mobile Wallets (apps that store your keys on your phone)

- Desktop Wallets (software for your computer)

- Smart card Wallets (like the advanced ones offered by Cryptnox)

Self-custody wallets are sometimes called “non-custodial wallets” because nobody else takes care of your crypto for you.

How Does a Self-Custody Wallet Work?

When you set up a self-custody wallet:

- A unique set of cryptographic keys is created on your device

- The private key lets you authorize transactions; never share this with anyone

- The public key acts like your account number people can use to send you funds

You’ll also receive a secret recovery phrase (or “seed phrase”). This is your golden backup, if you lose your device, you can recover your assets using this phrase, as long as you keep it safe.

Here’s a quick breakdown:

|

Type |

Who Holds the Keys? |

Who Decides on Transactions? |

Third-Party Involved? |

|

Self-Custody Wallet |

You |

You |

No |

|

Custodial Wallet |

Exchange/3rd Party |

Exchange/3rd Party |

Yes |

Why Choose a Self-Custody Wallet?

Let’s cut through the technical jargon and look at the top reasons why everyday people, not just crypto pros, are switching to self-custody in 2025.

1. Control and Independence

You’re the only one with access to your funds. No exchange, company, or hacker can freeze or move your money without your say-so. You’re no longer dependent on anyone else’s rules or reliability.

2. Advanced Security

Self-custody wallets, especially those with certified secure elements, protect your crypto from online hacks and exchange failures.

- In 2025, hardware wallet sales jumped by 31% due to rising concern over security.

- With providers like Cryptnox, security chips are certified to the EAL6+ Common Criteria. That’s bank-level security for your crypto.

3. Improved Privacy

Self-custody wallets typically don’t require names, emails, or addresses, just your keys.

- KYC isn’t required for many self-custody apps

- Your information and transaction history can stay private

4. Lower Costs

Since there’s no third party, many self-custody wallets avoid the fees you find with centralized exchanges, no hidden withdrawal “surprises.”

5. Future-Ready: Compatible with DeFi and New Tech

Self-custody gives you access to DeFi, NFTs, staking, and more, often before these features hit exchanges. Platforms like Cryptnox are already working on blockchain card dematerialization for future-proof solutions.

Are There Risks?

Yes, but they’re in your hands (literally). The same control that gives you freedom means it’s your job to keep your keys and recovery phrase safe. If you lose both, nobody, not even the wallet company, can recover your assets.

Extra tips:

- Write your recovery phrase on paper and store it offline

- Never share your keys or phrase with anyone

- Consider using hardware or smart card wallets, like those from Cryptnox, which are physically secure and easy to use

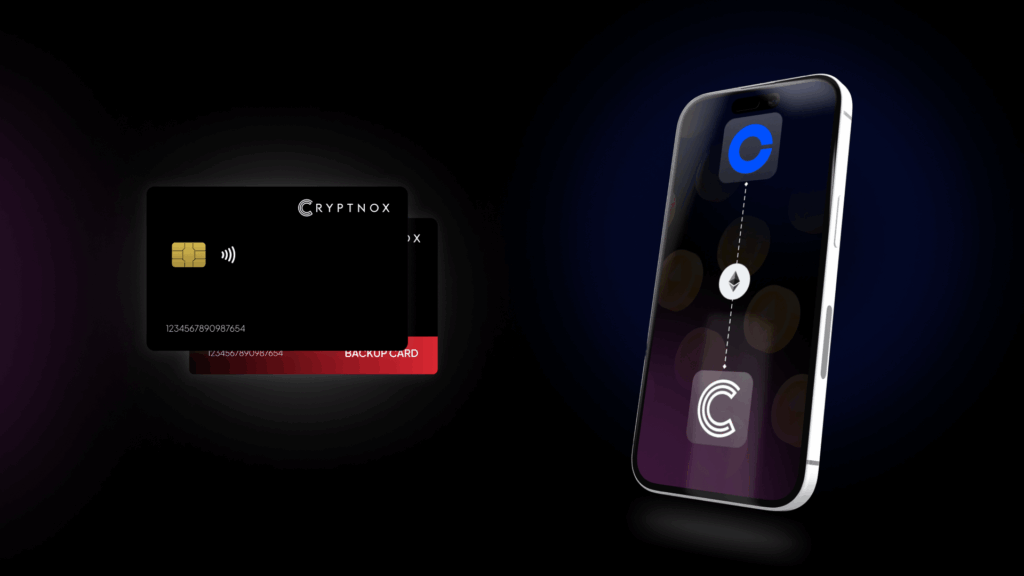

The Future: How Cryptnox Sets New Standards

Cryptnox specializes in advanced smart card technology for blockchain applications, focusing on secure authentication and digital asset management. Their solutions cater to both consumers and businesses, offering a seamless and user-friendly experience.

Key Features and Products

– FIDO2 Smartcard: Offers secure single- or two-factor authentication with FIDO2 Level 1 certification, ideal for personal and enterprise use. It supports passwordless authentication and is compatible with various platforms like Gmail, Facebook, and more.

– Hardware Wallet: Provides secure crypto storage with a dual-card backup system, biometric authentication, and seamless Web3 integration. It supports multiple blockchain networks, including Ethereum and Bitcoin.

– For Business: Cryptnox offers White Label Crypto cards specifically designed for banks, fintech companies, and financial institutions. These customizable hardware wallet cards enable secure and user-friendly cryptocurrency management while providing full regulatory control, allowing institutions to maintain compliance and oversight over their crypto services.

Innovations and Certifications:

– Cryptnox is a member of the FIDO Alliance and their products are based on chips with certifications such as EAL6+ Common Criteria and FIPS 140-2 Level 3, ensuring high-security standards.

– Their solutions are designed for simplicity and user experience, with ongoing research into blockchain card dematerialization.

Target Audience:

Cryptnox products are designed for both individual consumers seeking secure crypto management and businesses like fintech firms and banks looking to integrate advanced security solutions into their payment ecosystems.