The Emergence of DeFi and Bridge Aggregators: Simplifying Cross-Chain Transactions

The world of cryptocurrency is evolving rapidly, with decentralized finance (DeFi) and cross-chain transactions taking center stage. As the complexity of managing multiple assets across different blockchains grows, DeFi and bridge aggregators have emerged as essential tools. These platforms streamline the process, allowing users to swap assets and bridge between blockchains with ease. This blog delves into what DeFi and Bridge aggregators are, their significance, how to connect your wallet using WalletConnect and Cryptnox Card, and how they are transforming the cryptocurrency landscape.

What Are DeFi and Bridge Aggregators?

DeFi aggregators are platforms that consolidate various decentralized finance services, such as swaps, lending, and yield farming, into a single interface. They allow users to access multiple DeFi protocols without navigating different platforms individually. Bridge aggregators, on the other hand, focus on enabling seamless asset transfers between different blockchains. These platforms aggregate data from multiple bridges to provide the most efficient and cost-effective cross-chain transactions.

One of them to mention (among many others): Bungee Exchange

(https://www.bungee.exchange/)

Key Features of DeFi and Bridge Aggregators

Cross-Chain Swaps

Bridge aggregators simplify the process of swapping assets between different blockchains. They connect various decentralized exchanges (DEXs) and liquidity pools, allowing users to find the best rates and lowest fees for their transactions.

Unified Interface

Both DeFi and bridge aggregators offer a unified interface that consolidates various DeFi services. This feature allows users to access multiple protocols and perform transactions without switching between different platforms.

Optimized Routes

Aggregators like Bungee Exchange utilize algorithms to find the most efficient routes for cross-chain swaps. By analyzing liquidity and transaction costs, these platforms ensure that users get the best possible deals.

Security and Reliability

Leading aggregators implement robust security measures to protect user funds and data. This includes smart contract audits, encryption techniques, and multi-factor authentication to ensure a secure transaction environment.

Real-Time data and Analytics

Aggregators provide real-time data on asset prices, liquidity, and transaction fees. This information helps users make informed decisions and optimize their trading strategies.

Integration with DeFi Protocols

DeFi aggregators integrate with various protocols, allowing users to access lending, borrowing, staking, and yield farming services. This integration streamlines the user experience and enhances the efficiency of managing DeFi investments.

Examples of Transactions Using DeFi and Bridge Aggregators

Swapping Ethereum for Binance Coin (BNB)

Using a bridge aggregator, a user can seamlessly swap Ethereum (ETH) on the Ethereum network for Binance Coin (BNB) on the Binance Smart Chain. The aggregator finds the most efficient route, ensuring minimal fees and optimal transaction speed.

Staking Tokens Across Different Chains

A user might stake their tokens in a DeFi protocol on one blockchain and then bridge the rewards to another blockchain where they can be reinvested in a different protocol, maximizing their returns across platforms.

Yield Farming with Cross-Chain Assets

By utilizing a DeFi aggregator, a user can participate in yield farming across multiple chains. For example, they could provide liquidity on Uniswap (Ethereum) and then bridge the LP tokens to PancakeSwap (Binance Smart Chain) to earn additional rewards.

The Importance of DeFi and Bridge Aggregators

Efficiency and Convenience

Aggregators save users time and effort by providing a single platform to access multiple DeFi services and perform cross-chain swaps. This convenience is crucial in the fast-paced world of cryptocurrency.

Cost Savings

By aggregating data from multiple sources, these platforms help users find the best rates and lowest fees for their transactions. This can result in significant cost savings, especially for frequent traders.

Enhanced Decision-Making

Access to real-time data and analytics empowers users to make better-informed decisions. Whether it’s optimizing a yield farming strategy or choosing the best route for a cross-chain swap, having all necessary information at one’s fingertips is invaluable.

Market Transparency

Aggregators promote transparency by providing comprehensive and unbiased data. This transparency helps build trust among users and supports the overall maturation of the DeFi market.

Simplified User Experience

The unified interfaces of DeFi and bridge aggregators simplify the user experience, making it easier for both novice and experienced investors to navigate the complex world of decentralized finance.

What is WalletConnect and how it works

WalletConnect is a tool for crypto users. It acts like a bridge between your crypto wallet and decentralized applications (dApps) you want to interact with. Normally, these dApps would need to connect directly to your wallet, which might raise security concerns.

WalletConnect solves this by providing a secure connection. You use your phone’s crypto wallet app and scan a QR code from the dApp. This creates an encrypted connection where the dApp can send requests to your wallet, but your private keys (the most sensitive part) never leave your phone. You can then approve or reject these requests within your trusted wallet app.

How to Connect Your Wallet Using WalletConnect and Cryptnox Card

Connecting your wallet to DeFi and bridge aggregators is a straightforward process, and tools like WalletConnect and Cryptnox Card make it even easier.

How to use WalletConnect with Cryptnox

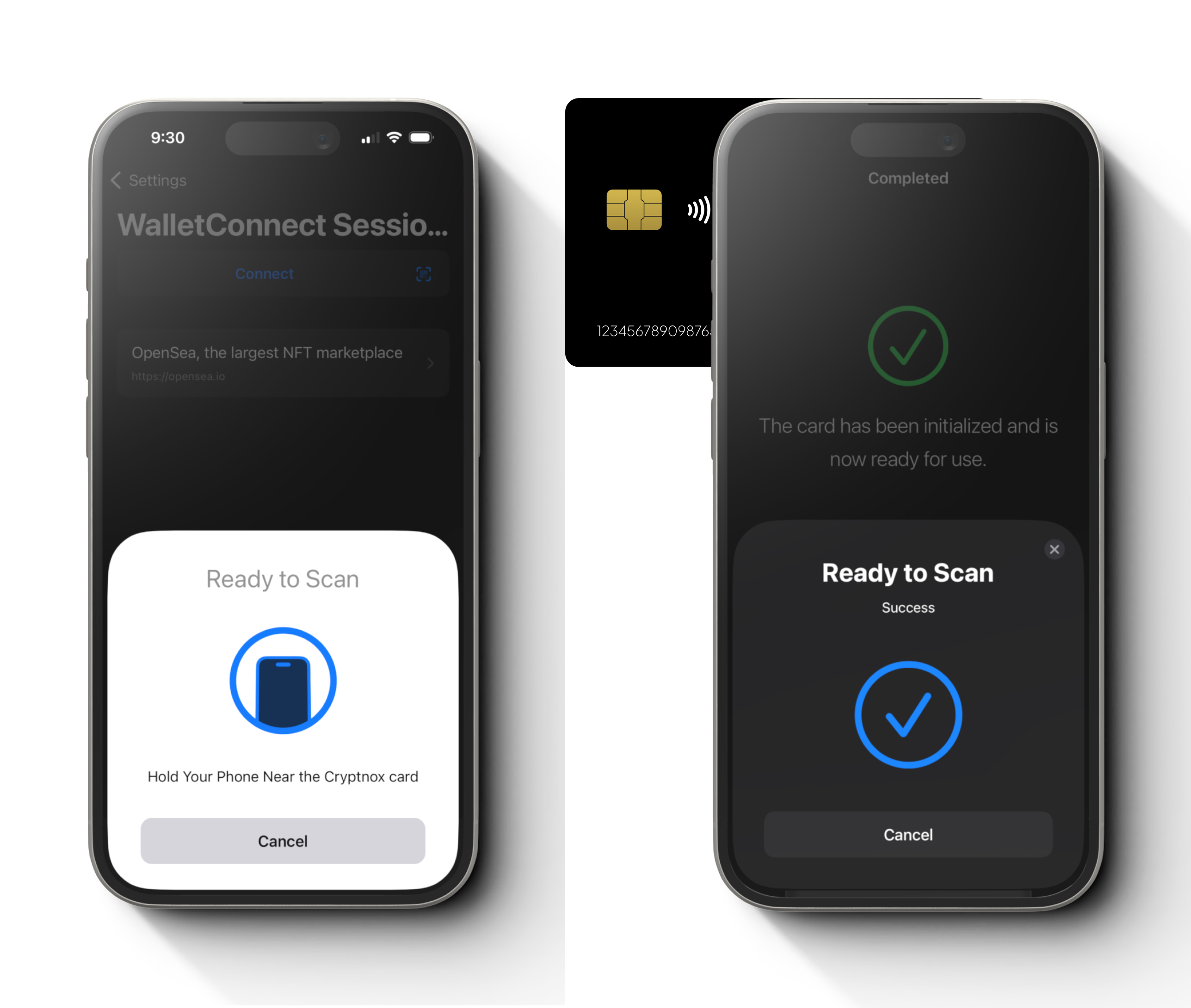

Important: Ensure that you have installed the Cryptnox App on your device and that an initialized hardware wallet card is linked to it.

Step 1

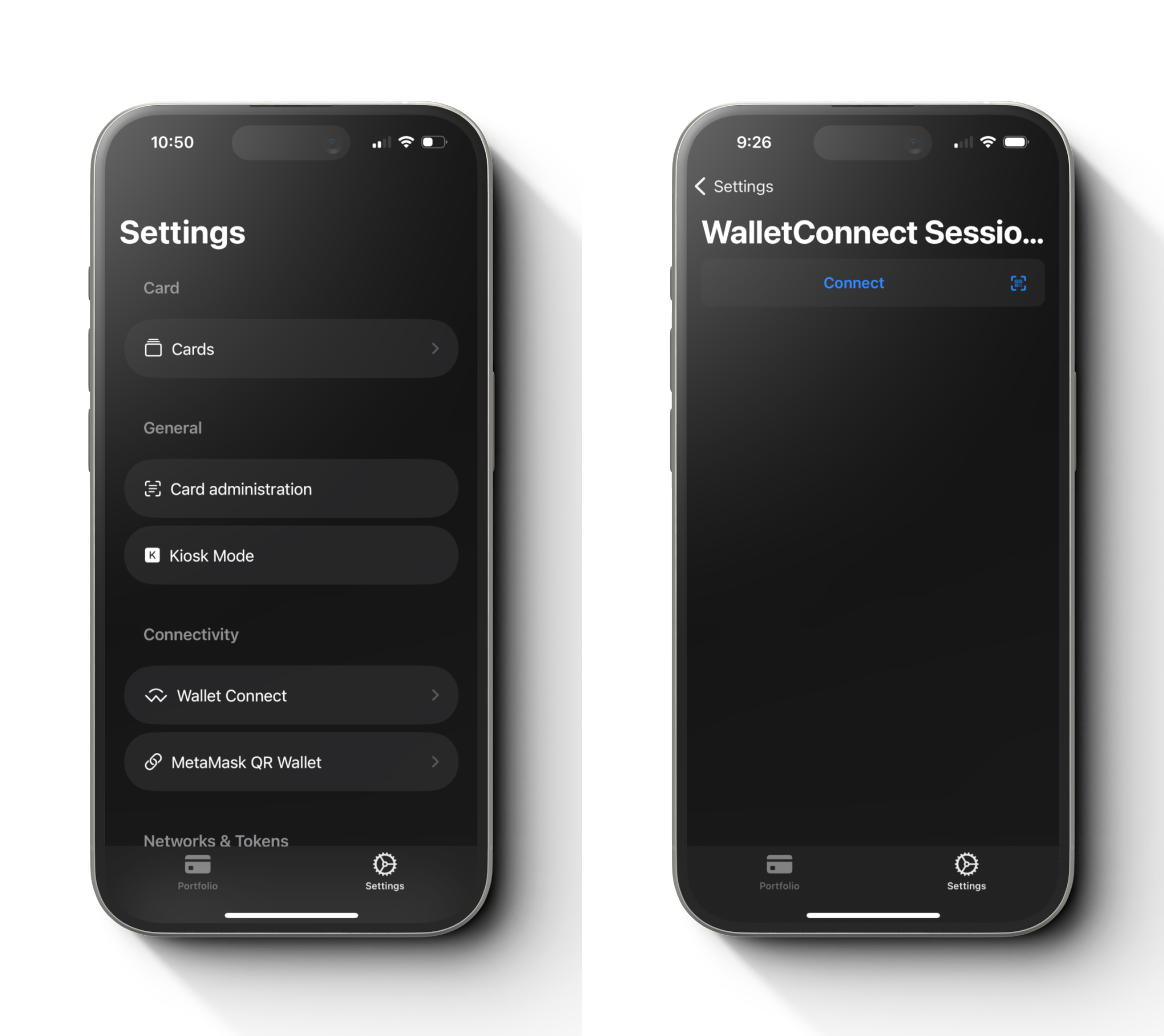

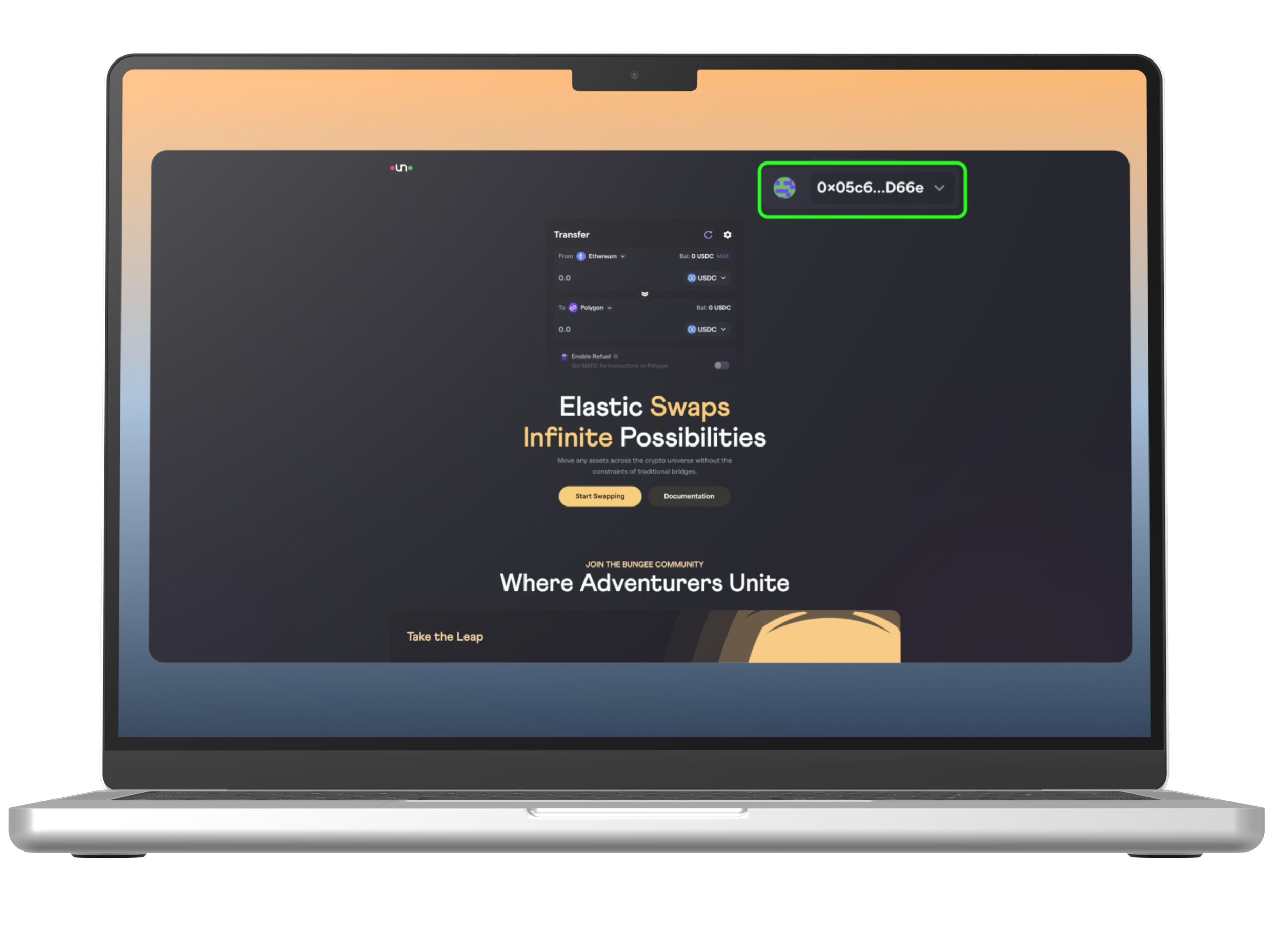

Go to the Web3 dapp website of your choice. In this example, we will connect your Cryptnox hardware wallet card to the Bungee Exchange.

Select “Connect Wallet” to start connecting your wallet.

Important: On some other Web3 Dapp websites, instead of “Login” it can display “Connect” (Uniswap) or “Connect Wallet” (Polygon Portal).

Step 2

In the list of options, select “WalletConnect” and you will see the QR code to scan from the phone.

Step 3

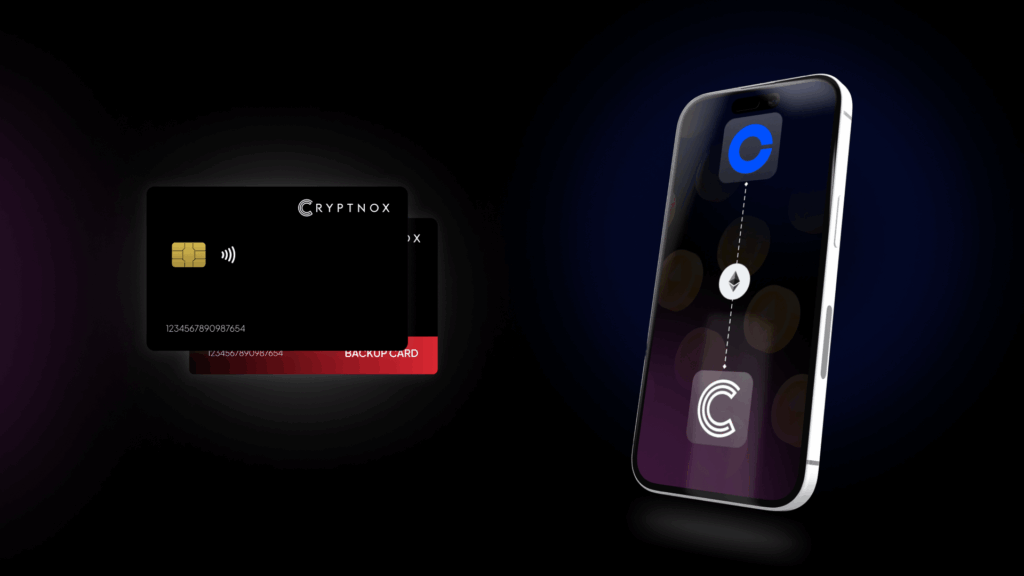

In the Cryptnox Wallet App, go to settings and select “WalletConnect”. Then press the “Connect” button and scan the QR code from the website.

Step 4

You will get to the screen with detailed information to link with WalletConnect. Press “Connect”.

Step 5

Scan your Cryptnox hardware wallet card to your phone when prompted.

Step 6

On the website, select “Accept and sign”.

Congratulations ! Here you have successfully linked your Cryptnox hardware wallet card to the Web3 Bungee Exchange using WalletConnect and the Cryptnox Wallet mobile application.

Integrating with DeFi Ecosystems and Beyond

As the cryptocurrency landscape expands, the scope of DeFi and bridge aggregators grows. Integration with various DeFi ecosystems is becoming a critical feature. DeFi represents a significant shift in the financial world, offering decentralized lending, borrowing, and trading without traditional intermediaries. Aggregators that integrate DeFi functionalities allow users to manage their DeFi investments alongside traditional crypto assets.

This integration is crucial as DeFi continues to grow in popularity and complexity. Users can benefit from having a single platform to manage both their traditional and DeFi assets, simplifying their overall investment management process. Moreover, aggregators that provide insights into DeFi projects can help users identify lucrative opportunities in this rapidly evolving space.

Security and Trustworthiness

Security is a paramount concern in the cryptocurrency world. Aggregators, by consolidating data from various sources, inherently increase the need for robust security measures. Leading platforms employ advanced encryption techniques and offer features such as two-factor authentication to ensure user data and assets are protected.

Trustworthiness also plays a significant role in the choice of an aggregator. Users need assurance that the data provided is accurate and unbiased. Reputable aggregators often have transparent methodologies for data collection and display, and they usually partner with well-known protocols and services to maintain credibility.

Future Prospects of DeFi and Bridge Aggregators

The future of DeFi and bridge aggregators looks promising with several potential advancements on the horizon. Enhanced artificial intelligence and machine learning algorithms could provide more sophisticated market analysis and predictive insights. These technologies could help users identify trends and opportunities that might not be immediately apparent through traditional analysis. Moreover, as regulatory environments around cryptocurrencies become clearer, aggregators may offer features that help users comply with legal requirements. This could include tax reporting tools, compliance checklists, and alerts about regulatory changes that might impact investments. The integration of blockchain technology directly into aggregator platforms could also revolutionize the way data is handled and presented. Blockchain’s transparency and immutability can ensure that the data displayed by aggregators is tamper-proof and accurate, further increasing user trust.

Conclusion

DeFi and bridge aggregators have become essential tools within the cryptocurrency ecosystem. They simplify the intricate world of digital assets, providing users with the information and tools necessary to navigate the market effectively. Whether you are a casual investor or an experienced trader, leveraging the power of a reliable aggregator can significantly improve your investment strategy and overall experience in the crypto space. By offering a centralized hub for cross-chain swaps, DeFi services, market analysis, and more, these aggregators are not merely conveniences—they are vital for anyone serious about staying informed and making